Yesterday, August 13, 2012, the Nasdaq halted trading in Deer Consumer Products (DEER) until the company has "fully satisfied Nasdaq's request for additional information." I applaud the Nasdaq's decision, coming over a year after I first questioned DEER here, here, and here. In today's report, I will show the likely reason DEER was finally halted.

Background

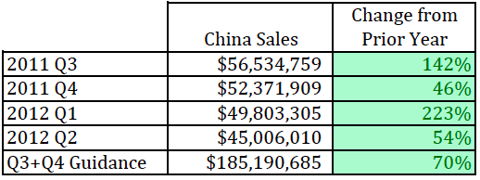

Deer Consumer Products has reported spectacular growth in sales from its Chinese domestic kitchen appliance manufacturing business each of the last four quarters, as well as reiterated truly stunning 2012 sales guidance, as shown in the following table:

Click to enlarge

Unfortunately for investors, DEER's miraculous growth is completely contradicted by the simple fact that its two exclusive manufacturing facilities in Yangjiang (appearing adjacent to each other outlined in yellow in the picture below) are completely idle.

Most recently, on August 3, 2012, I had an independent third-party investigator visit DEER's two Yangjiang factories. He noted that there was no sign of any production activities or workers other than security and maintenance personnel.

Two photos from his visit appear below.

The glaring questions are now:

1) How long ago were DEER's factories shut down?

2) Why were they shut down if manufacturing kitchen appliances is as profitable as DEER claims?

3) Why was there no 8-K disclosing the factories were shut down?

4) How many historical 10-Qs and 10-Ks need restatement?

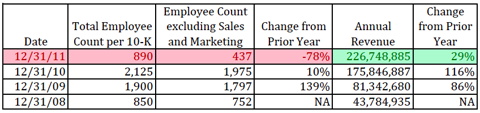

Some clues can be found in DEER's SEC filings. Consider DEER's reported headcount at year-end reported in its 10-K filings and reflected in the following table:

According to its 2011 10-K, at 12/31/11, DEER had only 437 employees (excluding sales and marketing staff), a decline of 78% from the prior year, despite a 29% increase in revenue. This contradicts the growth and earnings continuously reported by DEER and touted by Benjamin Wey of New York Global Group as the "world's largest producer of blenders and juicers."

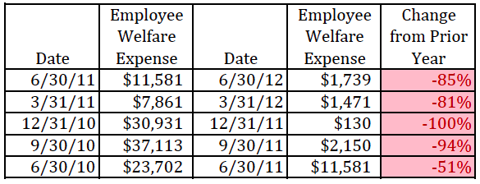

Likewise, DEER's reported employee welfare expenses reported in its 10-Qs have fallen to almost nothing in recent quarters, hardly indicative of a growing world-class company as shown in the following table:

Conclusion

Unable to disprove the evidence against the company, for over one year DEER has attempted to shield itself from my allegations by filing frivolous and abusive defamation suits to silence me. DEER's failed approach, like that of Sino Clean Energy (SCEI), will surely end in delisting.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

No comments:

Post a Comment