Posted in Citron Reports by Stocklemon on the July 19th, 2012

Freedom-to-Operate

may be Severely Compromised

Eight years ago this month, (yes Citron has been at it this

long), we published an article on Nitromed (NASDAQ:NTMD). Nitromed

received FDA approval to combine two generic pharmaceuticals and the stock

catapulted to over $20 a share, with every covering analyst posting a

"strong buy". Citron pointed out the problems in their business

model in the face of Wall Street. The company ended up selling itself 3

years later for .80 cents a share. The moral of the story is FDA approval

is not a short path to riches, and the importance of intellectual property

cannot be discounted when valuing a pharma company. For a drug with

purported "multi-billion dollar market potential", Citron is

astounded by the weakness of Vivus' intellectual property protection, and the

lack of due diligence on the Street, which allowed things to get so far without

a warning flag being dropped.

Citron has been carving to the bone on the Vivus / Qsymia weight

control pill story, and is convinced this is déjà vu all over again.

Similarities include:

·

A "blockbuster" drug — which is just a combination of

two readily available, inexpensive generics

·

A one-drug pharma company – with an abysmal track record long on

hype and failed execution

·

Notable absence of a deep-pockets marketing partner, having to

"go it alone" with its home-grown and risky marketing plan.

·

Vivus's intellectual property protection for its much publicized

diet drug Qsymia appears riddled with flaws

The Drug Story Background

With FDA approval obtained for its weight loss drug Qsymia, VVUS

stock price has tripled over the last year, fattening up its market cap close

to $3 billion, all for a drug that we believe will never become commercially

viable.

This report will identify major problems in the intellectual

property foundation supporting VVUS's weight loss drug.

Considering Vivus had a favorable 20-2 advisory panel

recommendation in hand in February, the company knew FDA

approval this week was a certainty. They have had the last 5 months to

sign a licensing / distribution / partnering / deal with a credible pharma

marketing company. J&J — a likely rights-holder in at least one of

the patents looming over Vivus' freedom to operate — would have obviously been

the company’s first phone call in February. Instead, insiders sold

virtually all their options-vested stock, and the company raised money from

investors.

After all, Vivus, is a 38-person company with scant history of

manufacturing or selling a drug. Why have they not been able to sign up a

marketing partner or a strategic investor for Qsymia over the past 5 months

? Citron finds this odd … Like Kate Upton not being able to find a

date. Possibly the problem here is no one wants to get in the middle of

what seems to be an inevitable intellectual property battle with J&J and/or

others that will likely delay and possibly threaten the production of Qsymia.

Because of this overhanging risk, any third parties supplying

topiramate to Vivus might be liable for contributory infringement for supplying

an Active Pharmaceutical Ingredient – a risk for any drug supplier who

knowingly infringes a patent.

Vivus's Intellectual Property Story:

Serious Doubts about its IP Protection

"You

can avoid reality, but you cannot avoid the consequences of avoiding

reality."

- Ayn Rand (1905-1982)

While the company has been busy furthering their FDA submission

and selling stock, Vivus has simply avoided confronting the reality that they

might not even be able to go to market.

The foundation stone of Vivus' IP protection is a patent

licensing deal signed a decade ago with a Dr. Najarian, an obesity doctor and

researcher who filed as sole inventor for Qsymia's two-drug combo. One

question that has been hanging over the company for years is the possibility of

patent infringement on one of Qsymia's two active ingredients, topiramate, a

patent held by Johnson & Johnson, who used to sell the drug as an obesity

treatment before it went generic. It affords patent protection until

2017. It originally was filed by a researcher named Shank on June 29,

1996 (US PTO No. 6,071,537)

You do not have to be a patent attorney to read the title of the

abstract:

"Anticonvulsant Derivatives Useful in Treating

Obesity"

There is no evidence of the validity of this patent ever being

challenged, either at the USPTO or the corresponding EP patent (EP0915697)

filed here. There are no mentions in Vivus' filings of the Shank patent,

and therefore no clues as to how Vivus plans to deal with it. They do say

in their 2011 10-K:

We are aware of issued patents

for the use of topiramate alone or in combination with other specific agents (zonisamide and mirtazapine) for

treatment of obesity and related indications e.g. prevention of weight gain.

We have worked closely with our patent counsel to put together a cogent patent

strategy and are building a strong patent portfolio in an attempt to obtain

exclusivity over the life of the patents.

And??? You've worked on it? What

is the answer?

How exactly does Vivus overcome the Shank patent to sell

topiramate for weight loss? Citron rates this unresolved question a substantial

risk factor.

Here is an answer given by Vivus head of corporate development,

Tim Morris at a recent conference when asked about the Shank patent:

TIM MORRIS: … this refers back

probably to the Shank patent which is owned by Ortho. And as you guys know,

topiramate was marketed by J&J for several years, it's now generic. We've

talked about this in the past.

We don't believe there's any issues in

terms of we've looked at the issue patents from Shank, we've looked at the

issue patents for us, several patent counsels have opined on them. Both patents

are issued and we think they're valid.

We don't believe there will be any

concern there. Obviously topiramate is not approved for obesity. We don't

believe J&J is making any money off topiramate for obesity. And so, no,

we're not concerned at all about J&J. It's obviously a topic for the Street

and people love to opine and write on it, but for us it's full

steam ahead.

It doesn’t make a difference if you think your patents are valid…what does

J&J think? Citron notes that …Tim Morris sold ALL of his Vivus common

stock the same week in February that the company received its favorable vote

from the FDA advisory panel …

This is Morris's version of "Full steam ahead" :

Yet, Vivus does slip this line in their filings:

We may be unable to in-license

intellectual property rights or technology necessary to develop and

commercialize our investigational drug candidates.

It is impossible to assess the market value of Qsymia

to Vivus until this issue is fully disclosed and resolved.

Potential Problems in Vivus's product

protection based on the Najarian patent.

As if the Stark patent issue was not enough, there are also

unanswered questions about the main patent Vivus appears to be relying on

behind Qsymia – the one licensed from Dr. Najarian. A condition was

introduced to the assignment agreement between Vivus and Dr. Najarian that made

future milestone payments contingent on the Najarian patents prevailing over

another, earlier-filed third-party patent by inventor McElroy. The

company found the McElroy patent important enough to make it a condition in the

licensing agreement with Najarian.

Very soon after Dr. Najarian assigned his patent to Vivus in

2001, the McElroy patent issued, with claims related to methods for treating

disorders that include obesity using sulfamates (including topiramate) in

combination with psychostimulants (including phentermine).

This is a second threat to Vivus's freedom-to-operate and, it is

referenced explicitly in the assignmentagreement

from Dr. Najarian on October 16,2001. (See 3.2.(ii) and 3.2.(ii) for

specific references ). In fact, payments to Dr. Najarian are explicitly

made contingent on "freedom to operate" with relation to the McElroy

patent.

It should be noted that Dr. Susan McElroy is the director of

psychopharmacology research at University

of Cincinnati and is

widely published on obesity and mental disorders.

Prior art is not pretty for Vivus:

The Najarian patent has a huge problem with regard to

dates. Simply, the McElroy patent's

provisional filing was earlier – Feb 24, 1999 – than the Najarian patent,

which was June 14, 1999 (search for "provisional" to verify these

dates). And note that McElroy's full filing appropriately references

the June 2000 Shank patent. It includes studies in which Binge Eating

Disorder patients were treated with open label topiramate in doses from 25 mg

to 1200 mg. (The use of phentermine at varying doses to treat

obesity was well known at the time.) Now, it remains possible that with

the proper documentary evidence, the Najarian patent defense could "swear

behind" the McElroy patent to get date precedent in the US – an uphill

struggle for Vivus. But such a claim will not hold up in Europe, because outside US jurisdictions, the provisional

patent filing date prevails.

Dr. Najarian's patent application doesn't reference McElroy

until he files this Supplemental

Information Disclosure dated

December 13, 2001 without further description. Najarian and Vivus obviously had to know about the significance of the McElroy patent,

because the entire Vivus assignment from Najarian in October 2001 is contingent

on Vivus obtaining freedom to operate without interference from the McElroy

patent specifically. But later patent filings state no reference to this

important prior patent application. Whether an intentional oversight or

impermissible intentional misstatement, it leaves open the door to a ruling

nullifying the Najarian patent in its entirety — yet another door opened for

patent litigation.

Obviousness is a problem for Vivus

In its simplest terms, US Patent Law requires that an invention

be novel and non-obvious. For example,

simply varying the dosing of a drug which shows side

effects proportional to dosage is not sufficiently novel to qualify for a

patent.

"The claimed combination has surprisingly fewer side effects than the

individual drugs."

"…I surprisingly found that the addition of a

sympathomimetic agent such as phentermine greatly diminished the side effects

of the topiramate. Further, this allowed patients who, previously, could

not tolerate topirate, to be able to take topiramate in combination with

phentermine. … "

This is an extremely important statement to the

patent.application's defense. Even if Dr. Najarian submitted this

statement in good faith, he has a duty of candor with regard throughout the

pendency of both the originally-filed and subsequently-filed applications to

disclose all information

known to the application that might impact patentability. The

question is, in light of the sizable studies performed on Qsymia to gain FDA

approval, and the copious commentary on its side effects, does Dr. Najarian

still believe the above statement is accurate and defensible? No side

effects observed with this drug combo ?

The huge body of clinical evidence, including Vivus' own studies

submitted for FDA approval, indicatethat

side effects of Qsymia are essentially proportional

to dosing. The very body of evidence that Vivus submits

for safety adds to the same exact body of evidence a challenger would use to

attack the Najarian patent for non-novelty and obviousness.

Referring to Vivus' own FDA Advisory Briefing Document (linked

below):

"As such, the side effects of

QNEXA [now Qsymia –ed.] therapy are expected to be consistent with those

described in the approved labeling for phentermine and topiramate, albeit at

a severity consistent with lower doses."

Any party challenging the Najarian patent will find they have

been handed extremely strong legal grounds to attack its validity on the above

comments.

Patent Ownership Uncertainties

There is further a question as to whether Dr. Najarian actually

owned the patent personally, as he filed. Or did he have an obligation to

assign his invention to one or more of his employers?

At the time his assignment to Vivus was executed, Dr. Najarian

was the VP of Medical Affairs and Medical director at Interneuron

Pharmaceuticals. Typically, work-related inventions such as this fall

under an employee's duties under employment agreements to be assigned to the

employer. Interneuron changed its name to Indevus, and was later bought

by Endo Pharmaceuticals.

Interneuron had some track record with weight loss drugs.

In fact, it was the producer of the widely prescribe Redux, recalled in

September 1997, due to correlation with heart valve problems. Redux

was a correlate of one half of the infamous "fen-phen"

combination. Clearly Dr. Najarian was deeply involved in weight loss

treatments. However Dr. Najarian lists himself as the sole

applicant. Vivus entered into its Assignment Agreement with

Najarian solely and personally. No further evidence of Najarian's

relationship was documented.

Further, records indicate Dr. Najarian was a staff physician at

two hospitals during the same timespan he cites administering this drug

combination to patients in what appear to be small informal trials referred to

in his patent application. Employment agreements both at drug companies

and medical centers routinely claim intellectual property rights from trials

conducted by employees in their facilities, unless specifically excepted, such

carve-outs never having been placed on the record in this case. Not to

mention, he appears to have been conducting drug trials without legal

oversight, and citing these to his own apparent benefit in his patent application.

If he argues they weren't "really" drug trials, but just ordinary

course doctoring, he undermines his own "non-obviousness" and

"novelty" arguments. It's quite a pickle once you think about

it.

Did Dr. Najarian have full rights to assign this patent to Vivus?

Do investors really think nobody will challenge this patent? Do they

really think the best strategy for maximum economic leverage for a patent

challenger has been anything other than to wait quietly until the FDA approved Qsymia,

rendering the patent more relevant, on Vivus's dime? If the patent's

original applicant assigned the rights to it improperly, is the patent still

valid? Who really owns those rights ?

Vivus has had not just the last 5 months, but 5 years since

questions about the Najarian, Shank and McElroy patents were posed by analysts,

to create enough clarity to go to market. Yet to this day, all we hear

from the company is assurances that they have legal opinions in hand stating

"they are OK". No joint ventures, no counterparty agreements,

no releases.

Quite a cloud of uncertainty for a "multi-billion dollar

opportunity" resting on the combination of two common generic drugs, don't

you think? If this were a solid pharma with high management credibility,

maybe investors could give them the benefit of the doubt. But this

management? Read on.

Competitive

Landscape: Generic Drug Competition

In its most recent 10-K, Vivus's disclosure speaks for itself:

"Our investigational drug

candidate, Qsymia, is a combination of drugs approved individually by the FDA

that are commercially available and marketed by other companies. As a

result, our drug may be the subject to substitution with individual drugs

contained in the Qsymia formulation and immediate competition. "

Beyond the above uncertainties surrounding Vivus' Intellectual

Property rights to this drug combination, the company faces tough market

challenges trying to enforce its territory in the marketplace. Because

the generic components of Qsymia are widely available, some doctors are likely

to continue to prescribe phentermine and topiramate (millions of prescriptions of each were

written last year, see FDA Advisory Briefing Document excerpt below). The

clinical trials of record provide plenty of protection from liability for

doctors making such choices. This places Vivus in the unenviable position

of trying to enforce non-patent exclusivity against prescribing

physicians.

In the words of Vivus' own FDA Advisory Briefing Document:

Phentermine hydrochloride at a labeled

dose up to 37.5 mg/part is the most prescribed weight-loss drug in the US with

approximately 6.5 million prescriptions written in 2011 [ IMS data]. A more recently

approved formulation of phentermine, Suprenza Tm, was approved in 2011. ….. More

than 10 million prescriptions were written in 2011 for topiramate [ IMS data ]. The majority of

current topiramate use is in migraine prophylaxis.

While these citations lend credibility to Vivus claims about the

drug's safety, the fact that bothingredients are available and

in wide use as

generics makes enforcing the company's patents far more challenging (and

perhaps raises hurdles to negotiating reimbursement).

CEO Wilson's stated strategy, that a combination of patent

protection, establishing a dosage regimen that is between strengths of

generically available competition (compare 46mg Qsymia to 50 mg generic

topiramate), and adding in time release features, create a barrier to entry for

Qsymia generic competitors. However, his own cited example for this

strategy (during a 2006 conference call) met quite an unfortunate end.

Ditropan from Alza Corporation, which was a controlled-release formulation of

oxybutinin, had its own patent ruled invalid just a month later — for

obviousness. [LINK]

The company's sales fell from $380 million prior to the ruling, to $15

million within a few years. He stopped citing Ditropan after that.

Vivus might be granted three years of non-patent exclusivity due

to providing a new clinical study and/or formulation, which is far less than

the 20 years from first filing that strong patent protection might

afford. But in the face of freedom-to-operate challenges above, Qsymia

might experience outcomes ranging from zero exclusivity to three years, or

partial three year exclusivity, shared with generics.

Translation: Severe pricing and competition

headwinds ahead.

Just for grins we looked up some prices on the Costco pharmacy

site. We found phentermine 15 mg at about 44c per pill, and topiramate

100 mg is about 23c per pill in Costco-sized bottles of 100. So that

would be about $20 a month for generic treatment at the top-level dosage of Qsymia (at

15mg/92mg). And the generic approach leaves doctor and patient free to

adjust or taper the proportion of the two drugs, flexibility they wouldn't have

with Qsymia … and, at no extra charge.

Vivus's Corporate

History: Failure to Execute

Vivus is not just any startup biopharma company. It has

been operating for over 20 years with the same CEO, Leland Wilson. Vivus

began its life as a publicly traded company pursuing a treatment for erectile

dysfunction for males. In the mid-1990's, iIt actually produced and brought to

market a treatment involving inserting a suppository into the male urethra.

Despite approval by the FDA and in Europe, a firestorm of hype, an initial

sales bubble, and a brief stock run to over $1 billion valuation, the product

failed to gain market share and was sold in 2010 to a 3rd party for just $23.5 million.

While Vivus's stock has languished in junk stock (sub $5) land

for most of the last 20 years, the company has pursued a variety of highly

promoted "stories", mostly concerning various attempts to introduce

products to treat so-called "feminine sexual dysfunction",

including testosterone spray and vasodilators.

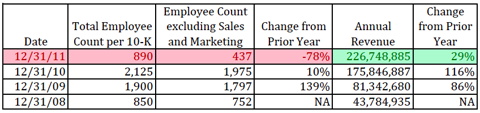

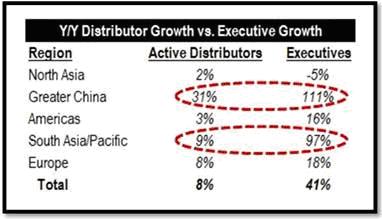

Despite the company's hype-marked history, the following table

is relevant to investors because Vivus's 20 year history illustrates one of the

most consistent records of failure in the history of publicly traded companies

in America.

Insider Sales

Regular readers of Citron know that we like to follow the

dollars. There's only only thing more disturbing than the hole where a

marketing or strategic partner should be — the amount of insider selling.

Insider sales in Vivus over the last twelve months are 1.7 million shares

between $9 and mid $20's, and current insider ownership is down to 0.29% according to

Bloomberg. Do we have to belabor the point that this is incredibly small

for a company with zero revenues that holds the license on "the next big thing"?

Conclusion

Despite years of lead time, Vivus' executives have failed to

provide strong patent protection for Qsymia. Taken together, these points

provide the best explanation yet why Vivus hasn't been able to recruit a

high-profile deep-pocketed pharma partner to leverage its expertise while

taking some of the risk of marketing its newly approved diet combo drug.

Instead of selling a stake to a credible pharma marketer, they sold

stock – over $230 million to …. you guessed it. The hope that a big

pharma company is going to ride in pay $3 billion for Vivus is ludicrous – the

strategy of trying to pierce its patent protection for a few million in legal

fees is a far lower risk.

The more marketing hype about the FDA approval of this

combination of two well-known and inexpensive legacy generic drugs, the more

Vivus sets up its own ambush – by legal challenges to its patent, and generic

drug competition starting before they can even get to market.

There is long track record in the US of diet drugs being horrible

investments, due to having a very short half-life. Consumers seem to move

from one fad to the next, only to discover there is little that substitutes for

exercise plus lowering caloric intake…. and we don’t even think this one gets

that far.

To conclude, Citron offers a two part generic prescription

·

For your

health:

Eat a diet

rich in nutrition and exercise. Eliminate junk food from your diet.

·

For your

prosperity:

Invest in

high-quality companies run by management with a strong track record of

success. Eliminate junk stocks from your portfolio.

Citron believes that in 1 year, Vivus's Qsymia revenues will be

exactly what they are today: 0.

Cautious (and healthy) Investing to all